Act on Authorisation of Public Interest Incorporated Associations and Foundations (Japanese/English)

Promoting Public Interest Activities by the Private Sector

Outline of 2008 Reform

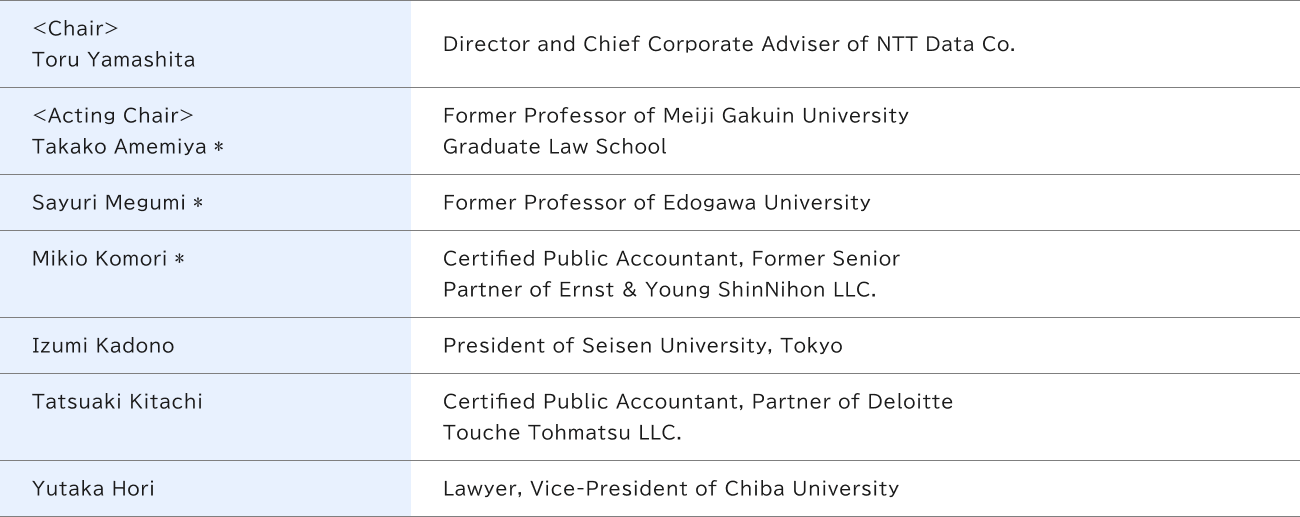

A major reform of the legal framework of Public Interest Corporations* took effect in Japan in December 2008, for the first time in 110 years. Three new Acts on “Public Interest Corporation” had been enacted in 2006 to replace the old system based on the “Civil Code” enacted in 1896. The old system allowed wide discretion to government Ministries in granting “permission” to the establishment of – i.e., granting corporate status to— Public Interest Corporations and regulating them; the new system is equipped with criteria and requirements clearly stated by law for both authorisation and regulation.

The new system aims to build a society in which non-governmental public interest activities prevail, through authorising new Public Interest Corporations and ensuring proper operations thereof by appropriate and prudent regulation in accordance with the new laws. Together with the enhanced tax incentives (see below), institutional framework for Public Interest Activities in Japan is completely modernised and updated.

* A “Corporation” is either an “Association” or “Foundation”; the same shall apply hereafter.

Some major points of change between the old and new are as follows:

As for the national level, respective Ministries were previously competent administrative agencies, which was a source of discrepancy in decisions made relating to permission and regulation of Public Interest Corporations. In contrast, now the Prime Minister, i.e., the Cabinet Office, is the sole competent administrative agency under the new system. It is also in charge of institutional matters.

As for the local level, 47 Prefectural Governors were, and are, in charge of administration. Prefectural Governors previously had administrative authority, however, that was delegated by respective Ministries and therefore subject to their guidance; they are now independent competent administrative agencies by law under the new system.

In addition, decision-making by a council, rather than through the usual administrative apparatus of the Minister/Prefectural Governors and their officials, is firmly built in the new system with respect to all the important decisions of competent administrative agencies.

Public Interest Commission, Cabinet Office

The Public Interest Commission* is a council established in the Cabinet Office and composed of seven Commissioners appointed by the Prime Minister, with the consent of both Houses of the Diet, from among private citizens for the term of three years.

The first term of Commission (April 2007 – March 2010) deliberated on the draft of Cabinet Orders and Ordinances, and prepared for the details of authorisation procedure before the new system went into effect on 1 December 2008.

It is the second term of Commission (April 2010 – March 2013), however, that dealt with the bulk of transition applications from former “Civil Code” Corporations. The third term of Commission (April 2013 present) followed suit. Approximately 4,500 applications of transition were filed with the Cabinet Office during the five years of “Transition Period” from 1 December 2008.

The third term of Commission saw the closing date of Transition Period on 30 November 2013. All transition applications were required to be filed by that date. Major task of the Commission has since then gradually shifted to the regulation of existing Public Interest Corporations, as well as encouraging new applications for authorisation from General Corporations established under the new scheme.

* It was also known as the “Public Interest Corporation Commission”. It has no power, however, on the act of incorporation; it has jurisdiction on authorisation of charitable status and regulation of Public Interest Corporations.

Roles of Commission

○ Upon consultation by the Prime Minister, the Commission shall:

(1) deliberate on authorisation of “Public Interest” Corporations both applied for by new General Corporations and by former “Civil Code” Corporations for transition;

(2) deliberate on the enactment, revision, or repeal of related Cabinet Orders and Cabinet Office Ordinances based on Act on authorisation of Public Interest Corporations or Act on Transition to new System; and

(3) deliberate on Regulations of, including Recommendations and Orders to, Public Interest Corporations, or Cancellation of their authorisation.

○ Entrusted by law, the Commission shall, in lieu of the Prime Minister, collect reports from Public Interest Corporations, make on-site inspections, and render other acts of regulation.

* Dispositions such as authorisation, order, etc., are made in the name of the Prime Minister based on the Commission’s decision.

* The Commission has its own Secretariat with staff members of about 120 (as of April 2013).

* Equivalent Councils consisting of non-governmental experts are established in 47 Prefectures.

Commissioners (Term of Office 3 Years: 1/4/2013~31/3/2016)

* Resident and full time

Objectives of 2008 Reform

The goal of the 2008 Reform is to promote sound development of non-governmental/not-for-profit activities, and thus contribute to the promotion of public interest activities by the private sector. To achieve that goal, it was necessary to address the problems bedevilled in the previous system, such as indistinctness and discrepancies both in permissions and regulation by competent Ministries due to their wide discretion.

Three new laws were enacted in 2006 to implement the Reform and enforced in 2008 (Law Nos.48-50 of 2006). Act on “General Corporations” stipulates the establishment and governance of General Corporations. Act on Authorisation of “Public Interest Corporations” stipulates criteria and requirements for both authorisation and regulation of Public Interest Corporations. Finally, so-called Act on “Transition” stipulates the procedures for transition of former “Civil Code” Corporations to the new system.

Outline of New Legal Framework of Public Interest Corporation in Japan

To promote public interest activities by the private sector, a major reform went into effect in 2008 for the first time in 110 years since the 1898 Civil Code.

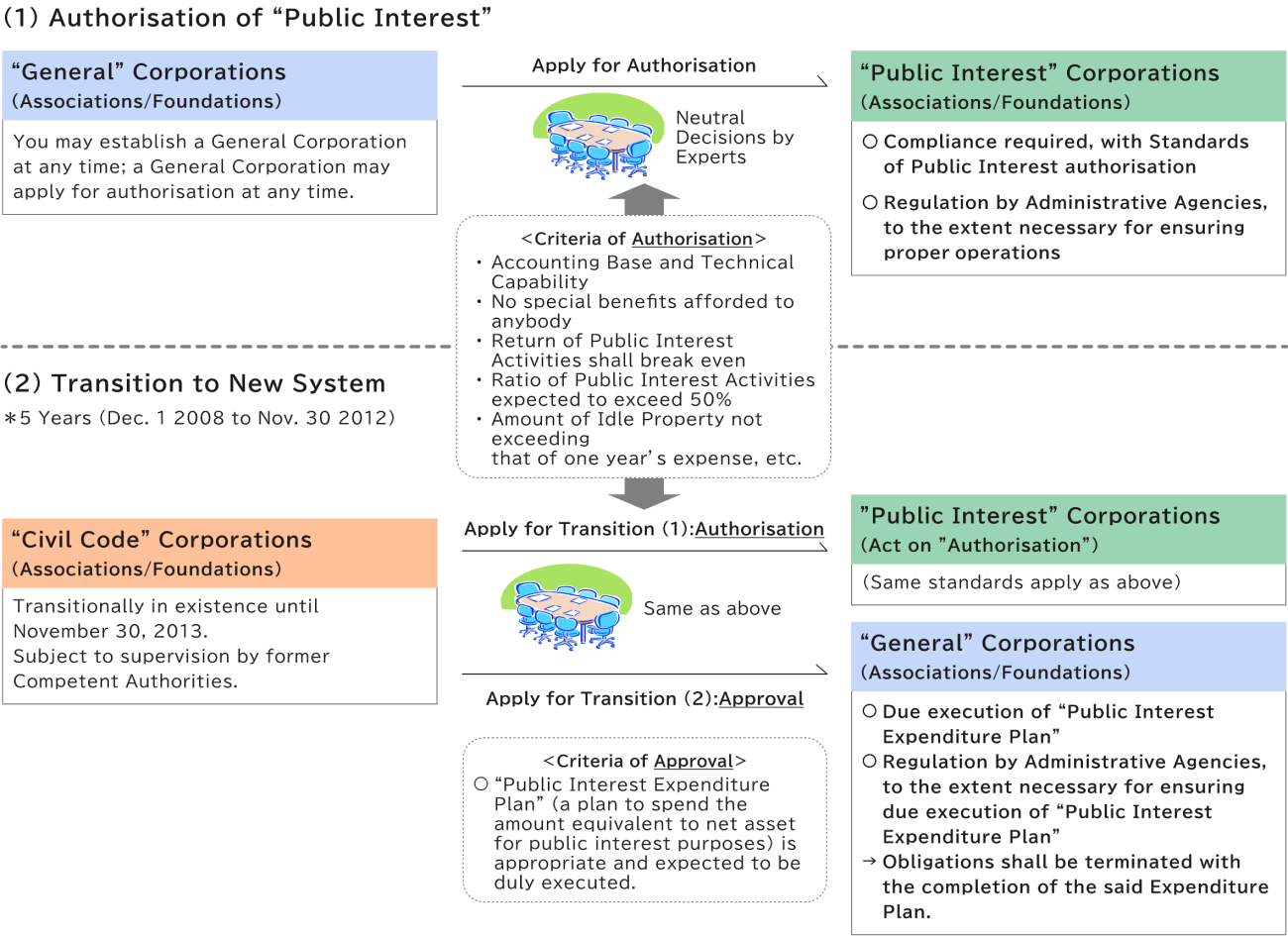

“Public Interest” Corporation under the New System

You can establish a General Corporation* by registration with a Registration Office. If authorised by the Prime Minister or a Prefectural Governor, it becomes a Public Interest Corporation. Public Interest Corporations with area of activities limited to a single Prefecture fall under the jurisdiction of the relevant Prefectural Governor. All others fall under that of the Prime Minister; the Cabinet Office and its Public Interest Commission is in charge.

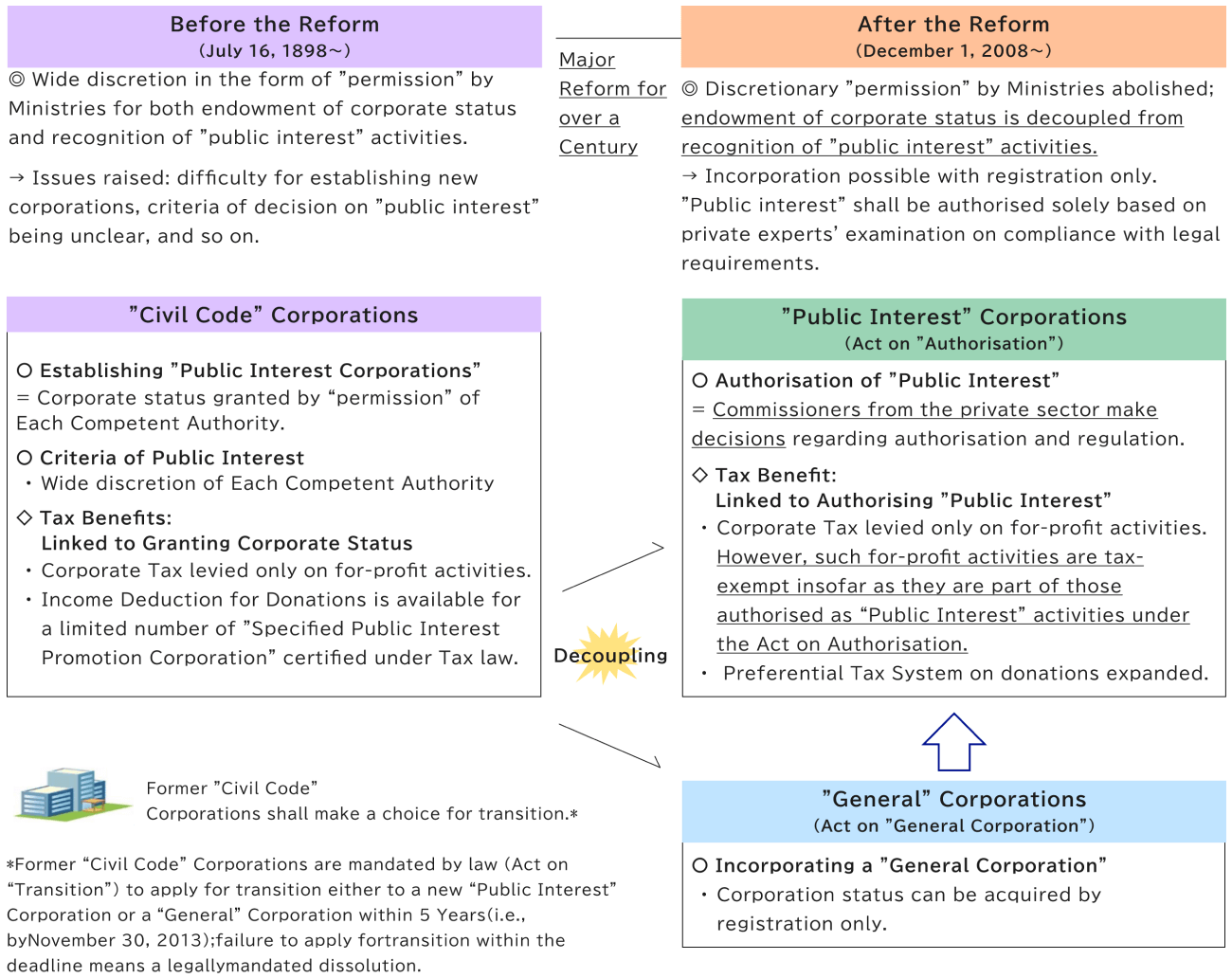

Former “Civil Code” Corporations were mandated by law to apply within five years (i.e., by 30 November 2013), for transition to the new system, i.e., either to become a new “General” or “Public Interest” Corporation. If the application did not meet the deadline, such corporation shall be by law deemed to be dissolved. The transition so far has been smooth. There were 24,317 “Civil Code” Corporations just before the 2008 Reform.* A total of 20,736 corporations have applied for transition during the five years: 9,054 (44%) filed for a new Public Interest Corporation; 11,682 (56%) filed for a General Corporation. Other 3,581 corporations were dissolved or merged**.

As of 31 December 2013, a total of 8,667 corporations have been authorised by the Prime Minister and Prefectural Governors and are in operation as new Public Interest Corporations: all based upon the recommendation by the Public Interest Commission or its prefectural counterparts. Of 8,667 in total, 289 are from newly established General Corporations and 8,378 from former “Civil Code” Corporations.

* Under the old system, there was virtually no other way than to become a “Civil Code” Corporation in order for an entity that was not necessarily “for profit” to get a corporate status. As a result, former “Civil Code” Corporation came to include over a century miscellaneous private entities that were not necessarily “for public interest”: from alumni, clubs, various mutual aid associations to those near to usual private businesses. The lack of clear criteria in law, wide discretion given to Ministries, huge socio-economic change since the Civil Code was enacted: all of these fostered this happen.

** Of which 426 were deemed to be dissolved due to non-filing by the said deadline.

Number of Corporations Transitioning to New System

It is estimated that, of total 24,317 former “Civil Code” Corporations (as of December 2008), about 10,000 will transition to new Public Interest Corporations.

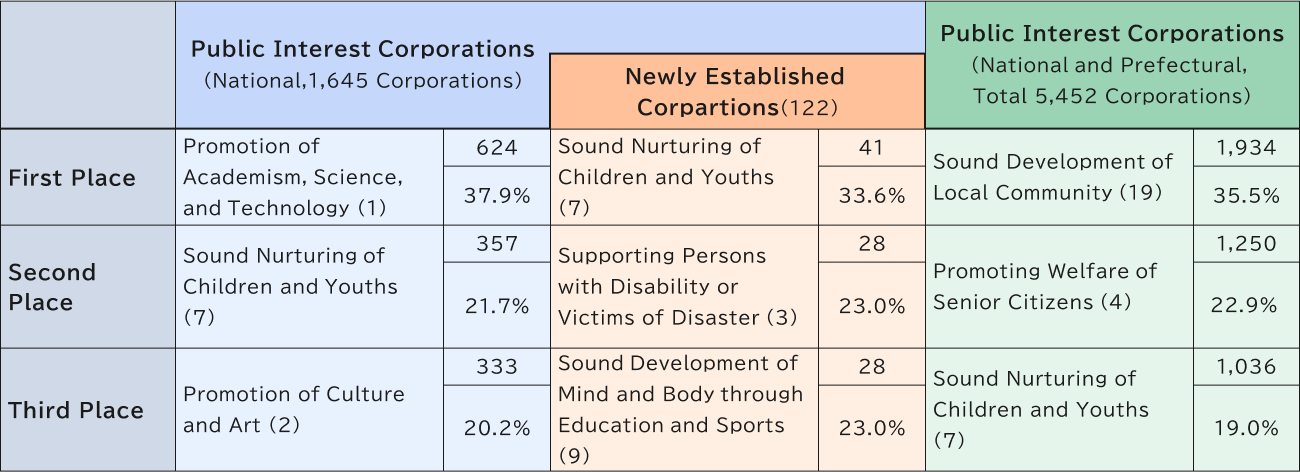

Area of Activities by Public Interest Corporations

As of December 2012, “Public Interest” Activities undertaken by 5,452 Public Interest Corporations Authorised are as below.

Definition of “Public Interest” Activities: activities relating to scholarship, art, charity or other pubic interest (as listed in the Appendix of the Act), and that contribute to the promotion of interest for “unspecified and many” persons.

* The number in brackets indicates the corresponding type of 23 ‘Public Interest’ Activities (see next page).

23 Types of Public Interest Activities

According to Article 2 of the Act of Authorisation of Public Interest Associations and Foundations (Law No.49 of 2006), for the purposes of the Act, a “Public Interest” purpose is a purpose that:

- falls within any of following descriptions (in the list of the Appendix of the Act) that relate to scholarship, art, charity or other public interests, and

- contributes to the promotion of interests of many and unspecified persons.

The Appendix of the Act enumerates the following 23 types of activities, to be pursued in order:

- to promote academism, science, and technology

- to promote culture and art

- to support persons with disabilities, needy persons, and victims of accident, disaster or crime

- to promote the welfare of senior citizens

- to support persons having the will to work forseeking the opportunity of employment

- to enhance public health

- to seek sound nurturing of children and youths

- to enhance the welfare of workers

- to contribute to sound development of mind and body of citizens and to cultivate human nature through education, sports, etc.

- to prevent crimes and to maintain security

- to prevent accidents and disasters

- to prevent and eliminate unreasonable discrimination and prejudice by reason of race, gender or others

- to pay respect and to protect freedom of thought and conscience, freedom of religion and of expression

- to promote the creation of a gender-equal society and otherwise better society

- to promote international mutual understanding and economic cooperation towards overseas developing regions

- to preserve the global environment and to protect and maintain the globe’s natural environment

- to utilize, maintain, and preserve the national land

- to contribute to the sound management of national politics

- to develop sound local communities

- to secure and promote fair and free opportunities for economic activity and to stabilize and enhance the lives of the citizenry through invigorating the economy

- to secure a stable supply of goods and energy indispensable for the lives of the citizenry

- to protect and promote the interest of general consumers, and

- In addition to the above, other types of activity that relates to the public interest, as prescribed by the Cabinet Order.

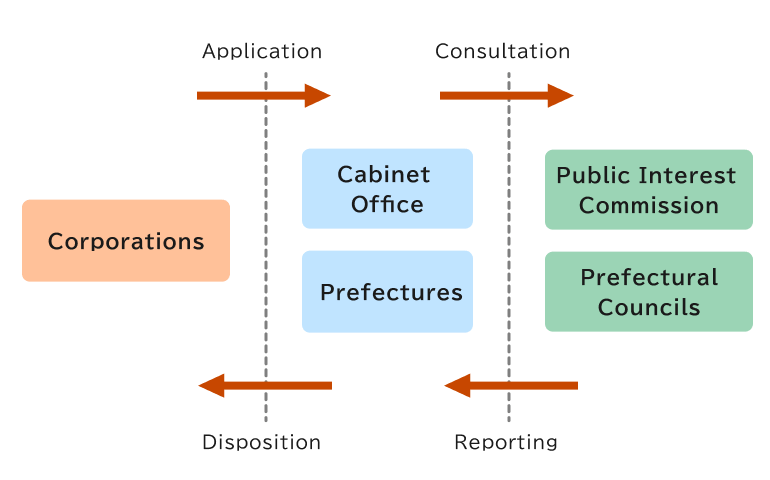

Steps to becoming a Public Interest Corporation

A General Corporation wishing to become a Public Interest Corporation shall apply for authorisation with the competent administrative agency in charge. Then, if decided that the application meets the criteria set forth in the Act on Authorisation of Public Interest Corporations, it shall be authorised as a Public Interest Corporation. Public Interest Commission of the Cabinet Office consisting of seven private experts, or its equivalent Councils* in 47 Prefectures, shall judge with neutrality and fairness whether the application meets the criteria of authorisation as set out in the law.

* Names vary from one Prefecture to another.

Public Interest Authorisation and Transition to New System

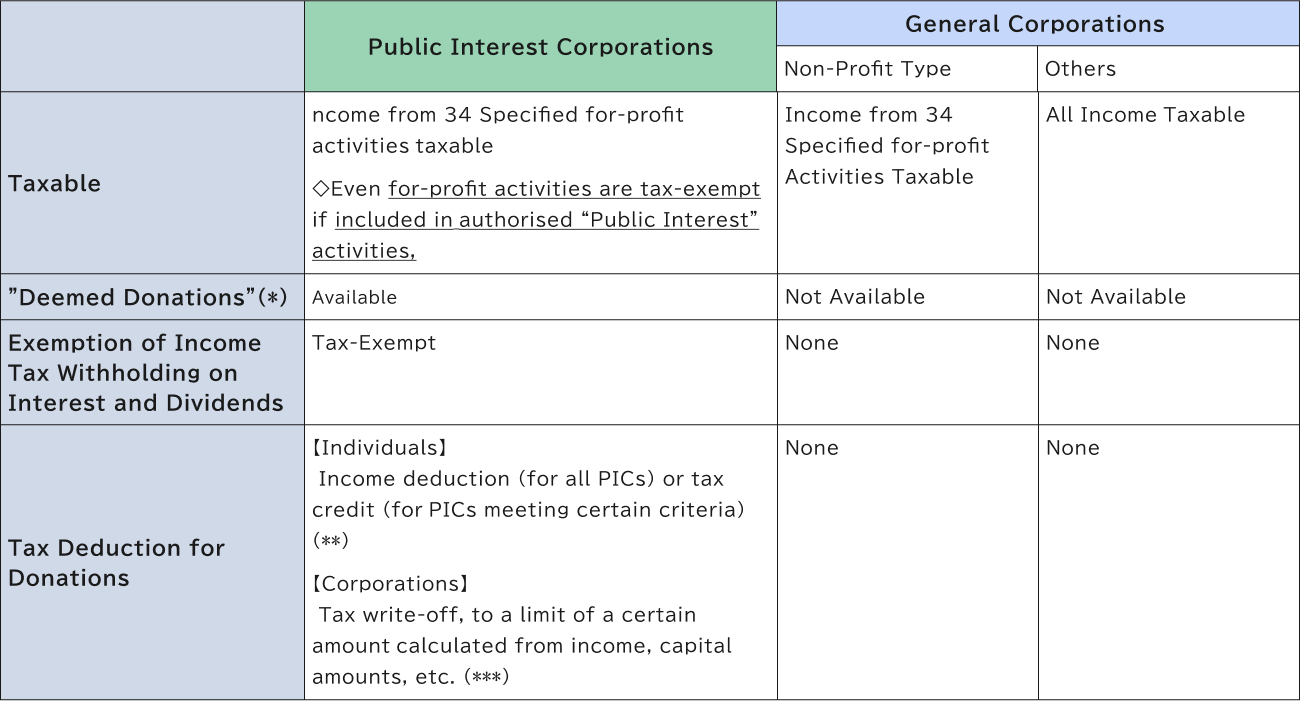

Tax Incentives

To promote public interest activities, tax incentives are provided by law for Public Interest Corporations that conduct “public interest” activities and comply with the authorisation criteria. Tax incentives for Public Interest Corporations in Japan have been drastically enhanced in 2008 and 2011*. Tax incentives for public interest activities are roughly twofold: taxation on profit from corporations’ activities, and that on donations made to them by citizens individual and corporate.

“Public interest” activities are exempt from Corporate Tax. It is levied only on 34 specific “for profit” types of businesses designated by a Cabinet ordinance. No Corporate Tax is levied even on such for-profit activities as fitting the 34 types, if they consist part of “Public Interest Activities” authorised by a competent administrative agency. Act on Authorisation require a Public Interest Corporation to transfer 50 per cent or more of the profit from its for-profit activities to its Public Interest Activities. Such amount transferred is deemed by tax law to be “donated” within the entity, therefore exempt from Corporate Tax.

Taxation on donations refers to Income Tax for individuals and Corporate Tax for companies. Income deduction is available for donations by individuals to Public Interest Corporations in general; tax credit is available for donations by individuals to those Public Interest Corporations that meet certain criteria (i.e., socalled “Public Support Test”)**. A separate tax write-off limit is available for donations by companies to Public Interest Corporations, in addition to the usual tax write-off limit for donations in general.

From the standpoint of tax law, corporations enjoying tax deduction for donations granted to them are called “Specified Public Interest Promotion Corporations (SPIPC)”. Previously, “Civil Code” Corporations needed to be recognised one by one as SPIPC. There were 862 “Civil Code” Corporations with SPIPC status as of April 2008. Under the new system, all the Public Interest Corporations, as they already pass legally mandated criteria, shall obtain by law SPIPC status. As a result, the number of “Public Interest” Corporations with SPIPC status has increased tenfold in five years of the Transition Period: 8,667 “Public Interest” Corporations with SPIPC status are in operation as of 31 December 2013.

* Tax credit for donations by individuals was introduced in FY2011 with the background of the Great East Japan Earthquake Disaster that year.

** A Public Interest Corporation passes the “Public Support Test” either if 1) it receives from the public 100 or more donations worth 3,000 yen or more per year, or 2) the total amount of donations it receives weighs 20 per cent or more of its total annual revenue.

Tax Incentives Under the New Public Interest Corporation System

* “Deemed Donations” allow corporations to get a certain amount of tax write-offs based on the tax laws. Public Interest Corporations (PICs) may write off the amount of money larger than either 50% of income, or the amount necessary for Public Interest Activities. ** For donations to all PICs, “amount donated – 2,000 yen” is eligible for a deduction from taxable income (up to the limit of 40% of income).

** For donations to PICs meeting certain criteria required by the tax laws such as “proven to be supported by citizens (‘Public Support Test’)”, “(amount donated – 2,000 yen) x 40%” is eligible for deduction from income tax (up to the limit of 25% of income tax). As such, tax credit could be effective even on a small donation.

*** In addition to the tax write-off limit {(Income amount X 2.5% + the amount of capital etc. X 0.25%) X 0.25} for general donations, a special tax write-off limit {(Income amount X 6.25% + the amount of capital etc. X 0.375%) X 0.5} is available for donations to all PICs.

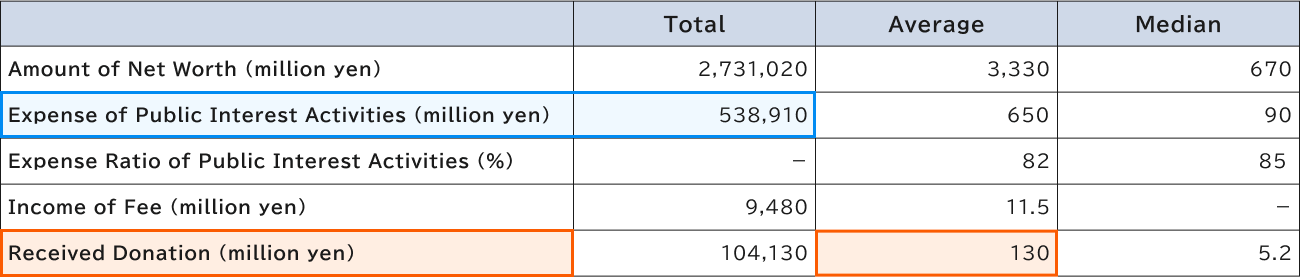

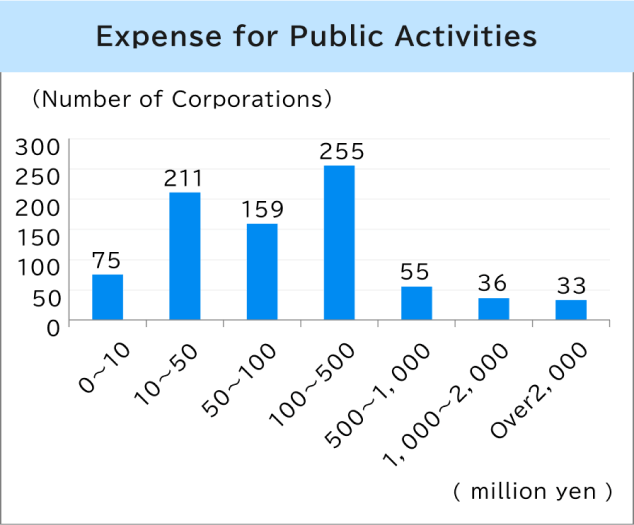

Financial Status of Public Interest Corporations

- Financial Status of those new Public Interest Corporations that submitted the FY 2011 Activity Report is as below. 824 Corporations spent a total of 540 billion yen for public interest purposes for the year.

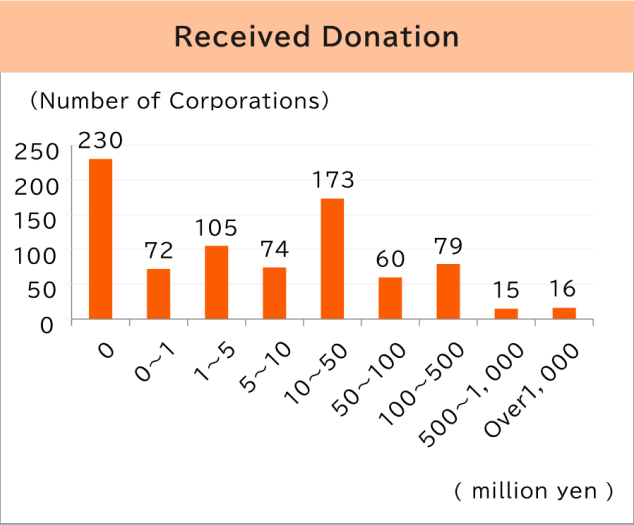

- A Public Interest Corporation under the new system received an average value of 130 million yen in donation, which was about three times as much as a former “Civil Code” Corporation (40 million yen). A total of 230 Corporations received no donations, however, which suggests room to expand their activities in future by receiving donations.

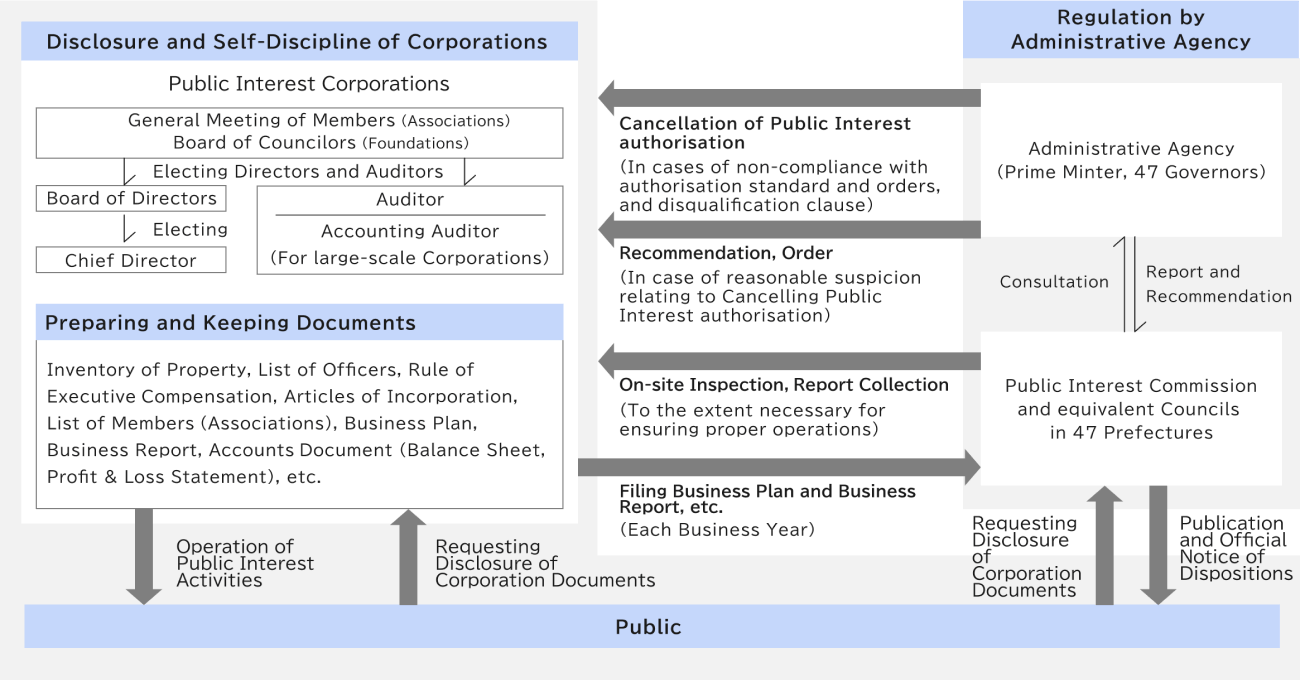

Regulation

Under the new system, the Public Interest Commission of the Cabinet Office is the regulator of Public Interest Corporations at the national level. The Commission collects reports from Public Interest Corporations, and makes on-site inspections to the extent necessary for ensuring their proper operations. It recommends, if necessary, the Prime Minister to issue recommendations and orders to a Public Interest Corporation under the law. Ultimately, it recommends the Prime Minister to repeal the authorisation given to a Public Interest Corporation in case of non-compliance of the order issued and serious violence of the relevant law. The Cabinet Office is also in charge of the supervision of General Corporations with the Expenditure Plan for Public Interest Purposes* it approved.

At the local level, i.e., in the case of a Public Interest Corporation whose area of activities is limited to a certain Prefecture, the regulator is the Prefectural council, which corresponds to the Public Interest Commission at the national level. By the same token, the Prefectural Governor replaces the Prime Minister, and the Prefectural Office replaces the Cabinet Office.

* A plan to spend for public interest purposes, after transition to a General Corporation, the amount of net assets that have been accumulated under preferential tax treatment as a “Civil Code” Corporation.

Governance, Disclosure, and Regulation of Public Interest Corporations

Disasters and Public Interest Activities

In Japan, through both the Great Hanshin-Awaji Earthquake Disaster in 1995 (17 January) and the Great East Japan Earthquake Disaster in 2011 (11 March), public interest and non-profit activities by Public Interest Corporations and others increased nationwide. A major reform of the legal system of Public Interest Corporations coincidentally went into effect in 2008 between the occurrences of the two tragic calamities.*

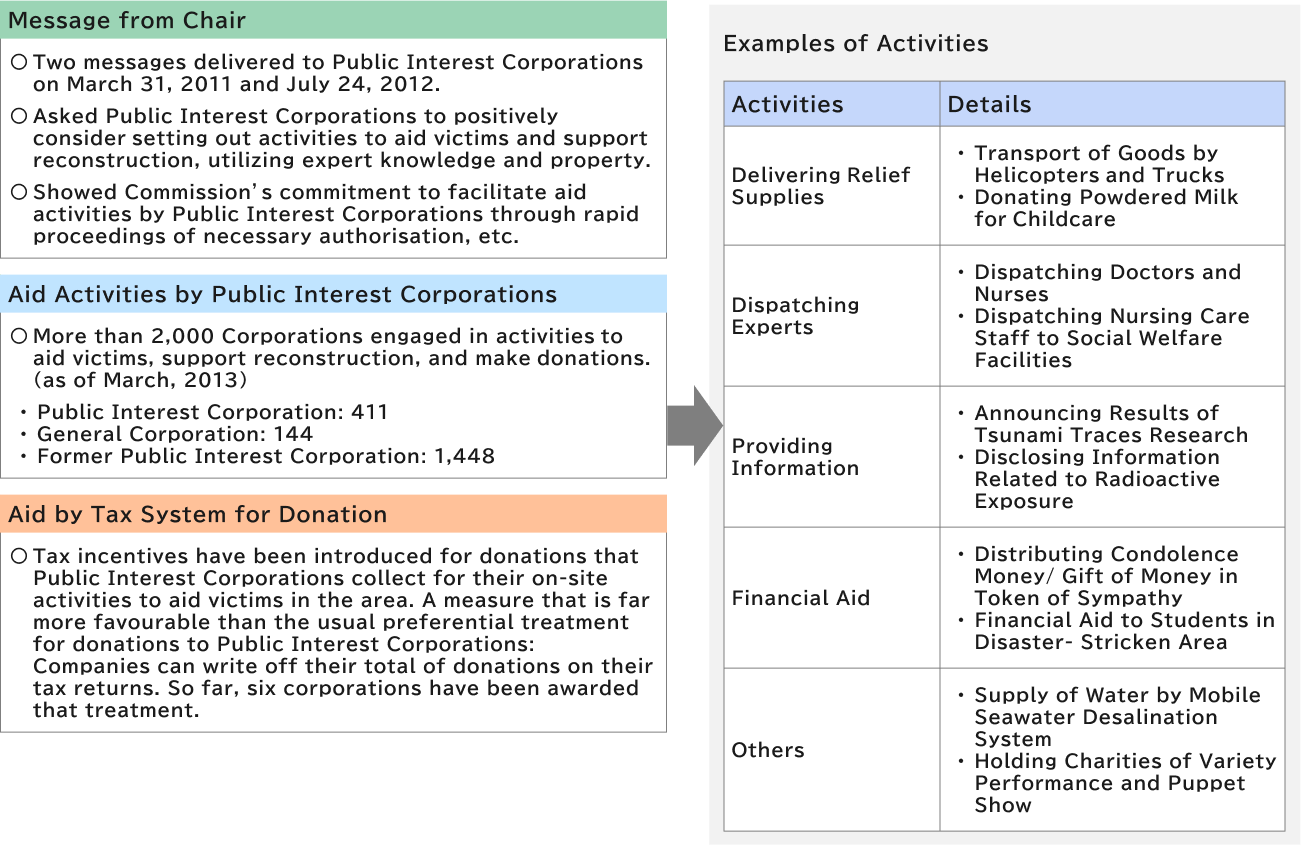

Shortly after the 2011 disaster, the then Chair of the Public Interest Commission called upon Public Interest Corporations nationwide to set out to aid victims and support reconstruction; the Commission itself showed its commitment through rapid proceedings of necessary authorisation for such disaster relief activities. More than 2,000 Public Interest Corporations responded to the Commission’s appeal.

Tax credit for donations by individuals was introduced in FY2011. It was introduced in the context of enhancing support and reconstruction activities by private entities in the areas stricken by the 2011 disaster. The scope of the measure is general, however; it has had the impact accordingly that is spread through the vast areas of public interest activities, and nationwide.

* So-called “NPO” Act (Law No.7 of 1998) was enacted and went into effect in 1998. “Specified Non-profit Activities” Corporation, usually cited as “NPO” even in Japanese, is another type of private sector entity in Japan for not-for-profit activities for general purposes. NPOs are more often, but not necessarily, chosen by locality-oriented, citizen-initiated, smaller type of associations. NPO is for an association only, and not for a foundation. According to Office of NPO, Cabinet Office, there are 48,465 NPOs in Japan as of end of July 2013.

Public Interest Corporations and the Great East Japan Earthquake

Uploaded on 8 May 2013

Updated and appended on 27 January 2014

Executive Office, Public Interest Commission

(Subject to review anytime)